Home

/

MFDost

Enabling the Next Generation of Mutual Fund Intermediaries

Presenting

MF Dost

Be a Financial Entrepreneur. Be a 'Dost' to India's Investors.

Let's get started!

What is Mutual Fund Dost?

"MF Dost" stands for “A Friend who can guide investors on their MF journey.”

True to its name, this initiative envisions building a community of friendly, neighbourhood Mutual Fund Distributors who combine trust with knowledge to guide investors toward smart and goal-based investing.

It is a movement to transform enterprising job seekers into self-employed financial entrepreneurs, building a new, digitally-enabled generation of Mutual Fund Distributors (MFDs).

Learn how mutual funds work

Get trained and pass the NISM exam for MFD

Start earning on investment you help with

Build confidence, respect and income

No fixed hours, no targets. Earn while managing your daily routine.

MF Dost program helps you build a professional and independent entrepreneurship

Why this Matters?

India's financial landscape is growing at a historic pace. Millions of new investors are

joining the market, looking for trusted guidance. But a critical gap remains:

A Historic Opportunity. A Critical Gap.

MF Dost is here to fill it

The Growth vs. Guide Gap

The Mutual Fund industry's AUM is expanding rapidly, but the number of active distributors has not kept pace.

The Inclusion Constraint

This gap in qualified intermediaries is a key constraint to achieving our nation's goal of true financial inclusion and mobilizing savings.

The Youth Opportunity

"MF Dost" is our investment in closing this gap. It's a pro-youth, pro-industry movement, offering a dignified, knowledge-based career path for self-reliant entrepreneurs.

Who can Join?

"MF Dost" is for educated, enterprising, and ambitious individuals with a passion for finance and a drive to build their own business.

An ambitious graduate

An existing financial advisor

A young professional seeking a new path

Anyone who wants to build a sustainable, knowledge based business

Note : It is not an offer of employment

What Will You Get?

Facilitation & Support

We will sponsor training support to help you clear the regulatory certification examination mandated by SEBI/ NISM.

Skill & Sales Training

Comprehensive sales, advisory, product, and ethics training to help you build a sustainable business.

Digital Enablement

A ready-to-use digital platform for seamless client onboarding, transaction execution, and portfolio monitoring.

Mentorship Opportunity

Guided career progression with mentorship from experienced distributors and AMC executives.

How Does it Work?

Fill in a short online form

Start your online training

Prepare and appear for the NISM exam

Get NISM certified as a Mutual Fund Distributor

Register With AMFI for ARN & start your journey

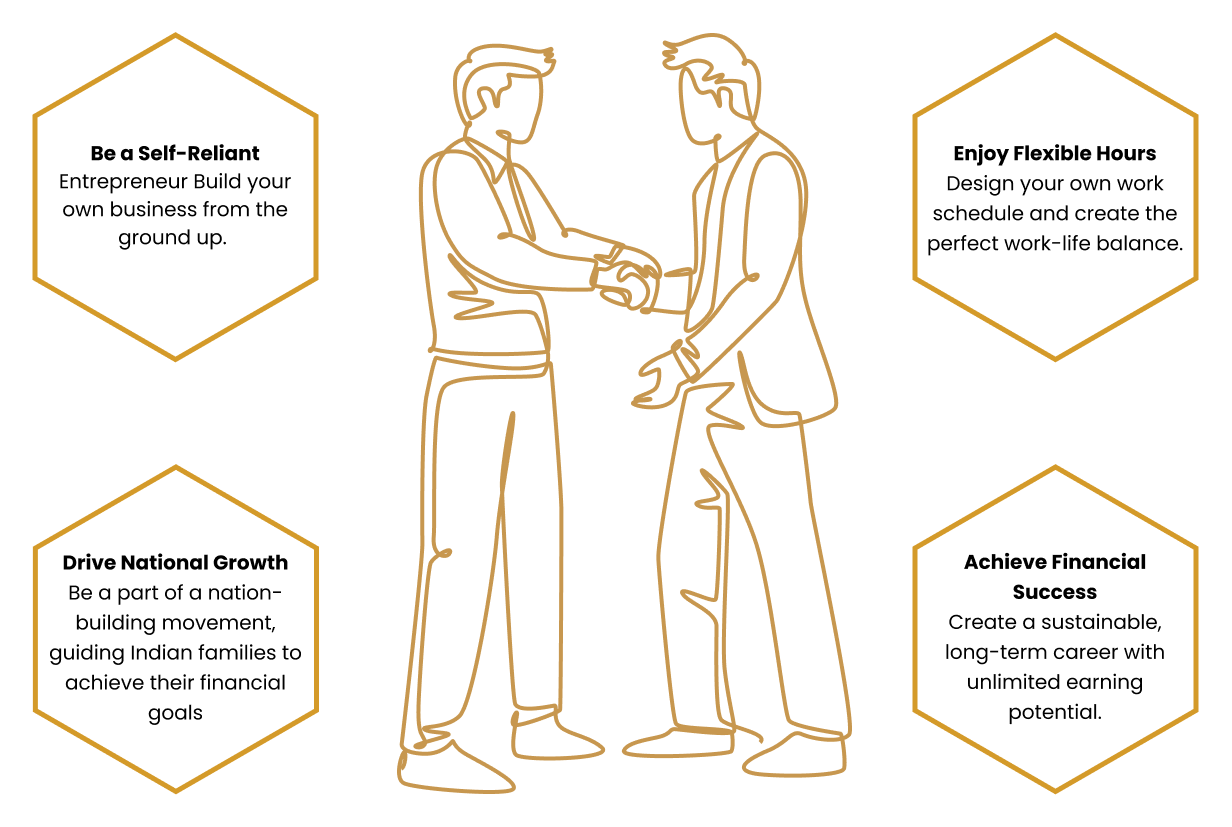

Why Become a MF Dost?

"When we launched The Wealth Company, our mission was to democratize wealth creation. 'MF Didi' was our first step in empowering women to become financial entrepreneurs."

Today, 'MF Dost' is our second, equally important step.

We are building an army of trusted, knowledgeable 'friends' - our 'Dosts' - who will be the architects of India's financial future. This program is our investment in you. It is our commitment to turning enterprising job seekers into self-reliant nation-builders.

Join us. Let's build a prosperous, financially-empowered Bharat, together.

- Madhu Lunawat

Founder, CEO & MD

Disclaimer: Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Terms & Conditions:

Wealth Company Asset Management Holdings Private Limited will handhold the candidate in the journey of becoming a MFD.

It is not an offer of employment.

Passing of NISM V-A is mandatory for becoming MFD. Please refer to https://www.amfiindia.com/ for details of eligiblity criteria for MFD.

The Wealth Company will only arrange for the coaching and training to prepare the candidates for the NISM test.

Candidates will be required to be attentive in the sessions and participate in the mock practices.

NISM exam fee (₹1,500 + GST) and Association of Mutual Funds in India (AMFI) registration fee (₹3,000 + GST) or as per current charges of AMFI and NISM, the above mentioned fee are not part of the program and will have to be paid separately by the participant.

NISM exam refer to NISM Series (V) - Exam for Mutual fund distributors.

© 2025. All Rights Reserved.